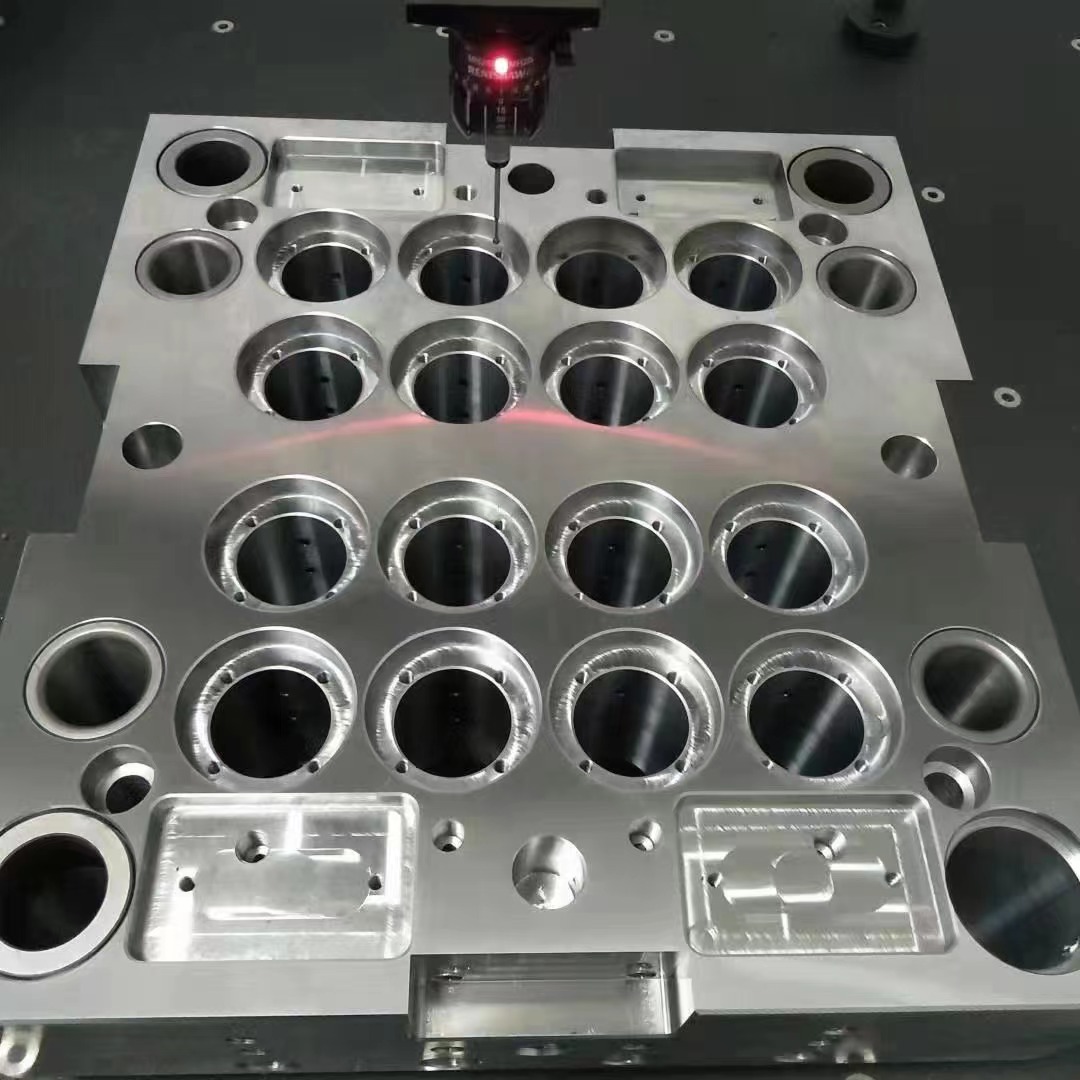

The Harmonized System (HS) code plays a crucial role in international trade, serving as a standardized numerical method for classifying traded products. When it comes to importing mold bases into the United States, having a comprehensive understanding of the relevant HS code not only facilitates smoother transactions but also ensures compliance with regulatory requirements. This article delves into the importance of mold base HS codes, how to determine the correct classification, and what to keep in mind during the importing process.

What is an HS Code?

The Harmonized System is an internationally standardized system of names and numbers for classifying traded products. Developed and maintained by the World Customs Organization (WCO), the HS code is a six-digit classification system that is used globally by customs authorities. In the U.S., the HS code expands to 10 digits to provide even more detail, often referred to as the HTS code (Harmonized Tariff Schedule).

Why is the Mold Base HS Code Important?

Understanding the HS code relevant to mold bases is critical for several reasons:

- Compliance: Proper classification helps meet U.S. Customs and Border Protection (CBP) regulations.

- Duties and Taxes: The HS code determines the tariff rates applicable to your imports, which can significantly affect the overall cost.

- Trade Statistics: Understanding trade data can assist in better business decisions regarding sourcing and sales.

- Streamlined Processes: Clear classification aids in expediting customs clearance, reducing delays.

How to Determine the Correct Mold Base HS Code

Finding the right HS code for mold bases requires a careful examination of specific characteristics and features of the product. Here are key points to consider when determining the correct mold base HS Code:

- Material Composition: Identify the primary material used in the mold base, such as steel, aluminum, or other composites.

- Function: Consider the mold base's intended use in manufacturing, which may dictate specific classifications.

- Design Specifications: Features like size, shape, and other design elements should be evaluated.

Common HS Codes for Mold Bases

While there are several potential HS codes associated with mold bases, some commonly used codes include:

| HS Code | Description | Duty Rate |

|---|---|---|

| 8480.71 | Mold bases for plastic manufacturing | 3.9% |

| 8480.79 | Other mold bases | 3.1% |

| 7326.90 | Other articles of iron or steel used in molds | 3.9% |

Importing Mold Bases: Steps to Follow

When importing mold bases to the U.S., following these steps can help ensure a smooth process:

- Conduct thorough research on the applicable HS code.

- Calculate estimated duties and taxes using the correct HS classification.

- Ensure all documentation is accurate, including invoices, packing lists, and shipping details.

- Choose a reliable customs broker to help navigate the complexities of importing.

- Stay informed about regulations and updates from U.S. Customs and Border Protection.

Challenges in Using HS Codes for Mold Bases

Despite their importance, several challenges can arise when using HS codes for mold bases:

- Complexity: The classification of specific items can be intricate and subject to various interpretations.

- Frequent Changes: Customs regulations and HS codes can change, making it crucial to stay updated.

- Misclassification Risks: Errors in classification can result in penalties, delays, or additional duties.

FAQs

What happens if I use the wrong HS code?

Using an incorrect HS code can result in penalties, additional duties, and delays in customs clearance. It is vital to ensure accurate classification to avoid these challenges.

How can I find the correct HS code for a specific mold base?

You can find the correct HS code by consulting the Harmonized Tariff Schedule available on the U.S. International Trade Commission’s website or working with a customs broker.

Is there a difference between HS code and HTS code?

Yes, HS code refers to the first six digits of classification, while HTS code is the expanded 10-digit classification used in the U.S.

Conclusion

The selection of the appropriate HS code for mold bases is vital in the import process into the United States. A thorough understanding of HS codes not only ensures compliance with regulations but also aids in the accurate assessment of applicable duties and taxes. By following the steps outlined in this article, businesses can effectively navigate the complexities of importing mold bases, mitigating risks associated with misclassification. Establishing a solid process for identifying and utilizing HS codes will significantly enhance the efficiency and effectiveness of your importing endeavors.